From ISF to IFI: Understanding the French Real Estate Wealth Tax Reform

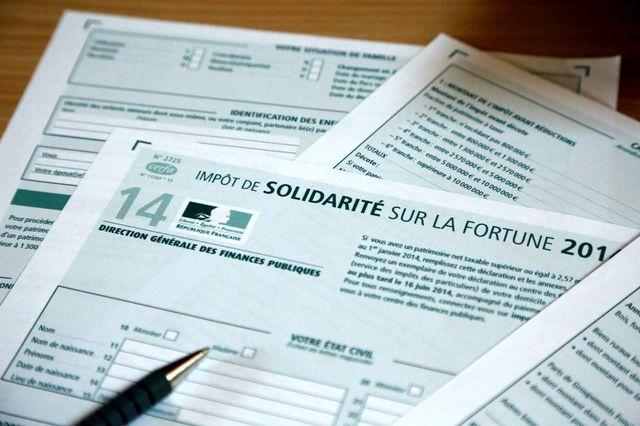

The transformation of France’s Solidarity Wealth Tax (ISF) into the Real Estate Wealth Tax (IFI) marks one of the most significant fiscal reforms of the past decade.

Introduced under President Emmanuel Macron, this measure aims to stimulate economic growth by reducing taxation on financial investments while focusing wealth taxation on real estate assets.

But how does this reform impact property owners and real estate investors in France?

A Shift in Taxation Toward Real Estate

Since January 1, 2018, the ISF has been replaced by the IFI (Impôt sur la Fortune Immobilière), a tax exclusively applied to real estate wealth.

In contrast, financial assets — such as bank deposits, stocks, bonds, investment funds, and life insurance — are now fully exempt.

According to France’s Ministry of Finance, this reform reduces the average tax burden for former ISF taxpayers by around 50%.

However, the benefit primarily favors wealthier households with financial assets, while those whose wealth is concentrated in real estate see little to no relief.

IFI Calculation Rules Remain Similar to ISF

The tax thresholds and progressive brackets are unchanged.

Taxpayers remain liable for IFI if the net value of their real estate assets exceeds €1.3 million as of January 1 each year.

The main principles are:

-

A 30% deduction on the market value of the primary residence,

-

Exemption for real estate used for professional purposes,

-

Exemption for furnished rental properties held under a professional landlord (LMP) status.

These provisions ensure that productive or income-generating assets continue to be treated favorably under the new framework.

What Does It Mean for Real Estate Investors?

Under the IFI, investors remain taxable on all privately owned real estate, whether residential, secondary, or rental.

Landlords may still apply discounts (decotes) on leased properties, depending on lease type and duration.

However, France’s Minister of Public Accounts has stated that commercial real estate contributing to the economy — such as offices, retail spaces, and business premises — could be exempted.

This approach aims to preserve investment in productive real estate while maintaining fiscal fairness.

For residential real estate investors, uncertainty remains.

It is still unclear whether SCPI shares (Sociétés Civiles de Placement Immobilier) — collective real estate investment vehicles — will be exempt when they focus on commercial properties, or remain taxable if invested in residential assets.

A Reform with Mixed Consequences

While the reform encourages investment in financial markets, it may discourage private investors from buying or renting residential properties.

For investors, this change underscores the importance of a diversified wealth strategy, balancing real estate and financial assets, and using optimized ownership structures such as French family real estate companies (SCI) or usufruct arrangements.

Strategic planning becomes essential to maintain performance and fiscal efficiency in a shifting regulatory environment.

Vaneau Patrimoine – Expertise in French Real Estate Wealth Management

At Vaneau Patrimoine, we guide both French and international clients through the complexities of property taxation and wealth structuring in France.

Our specialists provide tailored advice on:

-

Reducing your exposure to the French real estate wealth tax (IFI),

-

Optimizing ownership structures through SCI creation or family planning,

-

Diversifying your portfolio between real estate and financial investments,

-

Anticipating long-term inheritance and succession planning.

Tel: +33 (0)1 48 00 88 75

📧 contact@vaneau.fr

Vaneau News are powered by Google Traduction